Know Your Customer (KYC) - Customer identification

Handle customer identification requirements mandated by the Anti-Money Laundering Act effortlessly, quickly, and securely with Signom KYC Service.

By making the transition from outdated and slow processes to seamless electronic interactions, you'll free up countless hours of your valuable time.

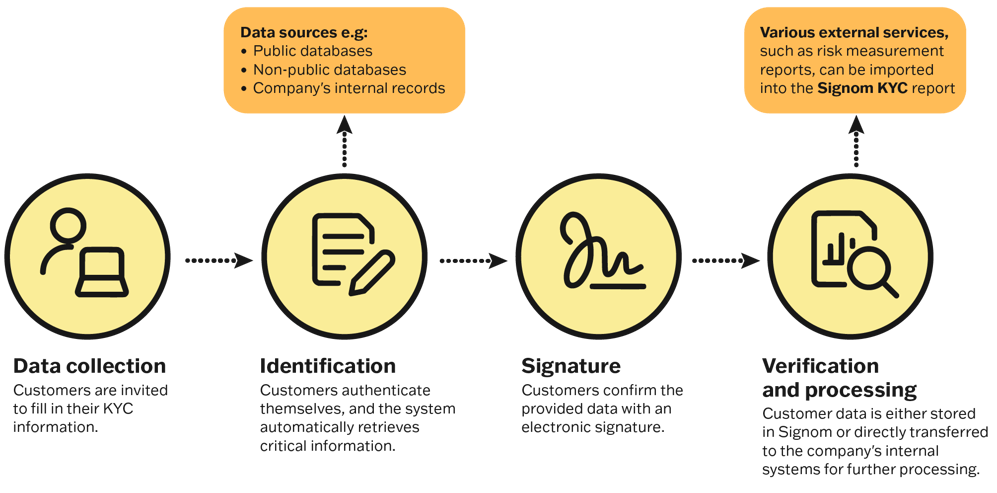

Automate the identification and verification of the client's identity (KYC) as well as the signature process

Signom KYC Service provides an efficient, secure, and user-friendly way to collect the necessary identification information from customers – as required by the Anti-Money Laundering Act.

Users can easily provide their details to Signom, after which verifying and processing the information is quick and straightforward for the KYC team.

When Signom automatically guides and instructs your customers through the process, identity verification and data collection become significantly faster.

Signom has been used extensively to collect know-your-customer information from various industries, enabling the development of best practices for collecting information from different legal entities and identifying specific requirements for certain entity types.

The ISO 27001-certified information security management system ensures error-free and worry-free services through its rigorous processes.

Contact us for more information or book a demonstration

Anti-Money Laundering Act and customer identification

The updated Anti-Money Laundering Act requires companies to collect and retain customer identification information.

The act applies to various types of businesses, including:

Business service providers

Investment and financial services

Insurance and pension insurance companies

Real estate agencies

Legal and law firms

Accounting, bookkeeping, and auditing services

Non-compliance with customer identification requirements is taken very seriously by regulatory authorities.

Core obligations of the Anti-Money Laundering Act

Identify your customers and verify their identity

You must also identify the customer's representative and verify their identity, as well as ensure the representative's authority to act on behalf of the customer.

Determine the beneficial owners of your corporate customers

Identify the owners of the company, as well as those who exercise control over the company.

Know your customers and

their activities

Continuously monitor activities to detect suspicious transactions.

Benefits of Signom KYC Service at a glance

Compliance with legislation

The service helps you comply with legislation and standards, such as the Anti-Money Laundering Act and the General Data Protection Regulation (GDPR), by providing a reliable and secure way to collect and process personal data.

Efficiency and time savings

Automatic data collection can reduce or even eliminate many manual steps, making the verification and monitoring of the provided information easy and fast.

Accurate information for specific needs

Get a service that is tailored to the specific needs of your company, addressing the critical issues that arise in your industry and business.

The service can be used for onboarding new customers and updating information for existing customers.

Better customer experience

Our system allows users to provide identification details at the most suitable moment, with registry information pre-filled.

Users only need to answer questions relevant to their own company, eliminating unnecessary inquiries; for instance, sole proprietors won't be prompted for board-related information.

Easy integration

Easily import or verify customer data directly into the customer's own systems, reducing manual work, minimizing errors, and saving time. Plus, integrate external services, such as risk assessment reports, into the Signom KYC report.

Easily scalable

The service is scalable and facilitates the addition of new features and content customization as your needs evolve.

Leave your contact details and we will get back to you as soon as possible

Signom - the most versatile electronic signature service

Signom KYC Service is part of Signom's electronic signature service, which helps automate and digitize business and customer processes. Whether it's onboarding customers, verifying their identities, or facilitating document signing like contracts and reports, Signom ensures a smooth and effortless experience.

Automated customer data verification in accordance with KYC processes ensures efficient and seamless signing, identity verification, and information gathering. Signom's easily customizable and scalable solution suits the demanding needs of both small businesses and large companies with complex organizational structures and signature processes that require automated workflows and extensive integrations.

Leave your contact details and we will get back to you as soon as possible

Numerous companies already trust Signom

-

"The time savings brought by the KYC service are significant: It eases the daily routine of the branch by freeing up time from data filling meetings to other tasks, and for the client, it provides considerable time savings and freedom, as the identification information can be filled out even from your own couch whenever it suits best."Yasmin VikiönkorpiDevelopment Manager (KYC), POP Bank Group

-

“Almost anything that requires strong authentication and an electronic signature can be done with Signom. I'm super happy with our cooperation.”

Tia RytkönenDirect and Corporate Sales, St1 -

"The cooperation with Signom has boosted our sales and helped us build new digital business models."

Lauri VaronenSales Director, Toyota Finance Finland Oy -

"We have been able to trust Signom’s speedy delivery, technical functionality, and ability to tailor solutions specifically for us."

Mirka MäkinenInformation Systems Development Manager, Kiinteistömaailma